Which bank account can you recommend in Canada?

Do I need a bank account in Canada?

If you are going to work in Canada, you definitely should have a Canadian bank account because it makes your life so much easier. In today’s modern world, most employers no longer write checks, but transfer wages directly to the account via Direct Deposit. You need the bank account not only to get your hard-earned money from your employer, but also to pay rent and utilities.

Opening a bank account in Canada is easy. You just walk in and within 15 minutes you walk out. You will receive a debit card on the spot and most likely a credit card will be offered which will be sent to you via mail.

Some banks require an appointment first, but don’t let that put you off. Just go to the nearest branch and if there are no appointments available, you can make one on the spot for a few days later, or walk into another branch to see if someone can serve you right away.

Which bank is best?

Since you travel to many different places during your Work and Travel, you should keep in mind when choosing the bank that it is represented throughout Canada and has many ATMs. The largest and most widespread banks in Canada are the “Big Five”.

No matter which bank you choose, all banks have newcomer accounts where the first year is free.

Big Five

- Royal Bank of Canada (RBC)

- Toronto-Dominion Bank (TD)

- Bank of Nova Scotia (Scotiabank)

- Bank of Montreal (BMO)

- Canadian Imperial Bank of Commerce (CIBC)

What can you recommend?

Personally, I can recommend the CIBC, where I only have had good experiences. They have branches and ATM machines all over Canada. The CIBC Smart™ Account for Newcomers is free for two years .

If CIBC also offers you a credit card that is free, then choose the one with cashback. You get cashback on gas, groceries, restaurants, and certain % on the rest if you pay by credit card. From $25 accumulated cashback you can credit this against the credit card bill. Depending on your spending habits, as much as $300 cashback and more can accumulate throughout the year. It is gifted ♪♫♪money, money, money♫♪♫

Disclaimer: I might receive a commission if you are using the above affiliate link, but it will not cost you anything. This makes it possible to support all Work and Travellers on the Working Holiday Canada adventure. Thanks a lot for the support.

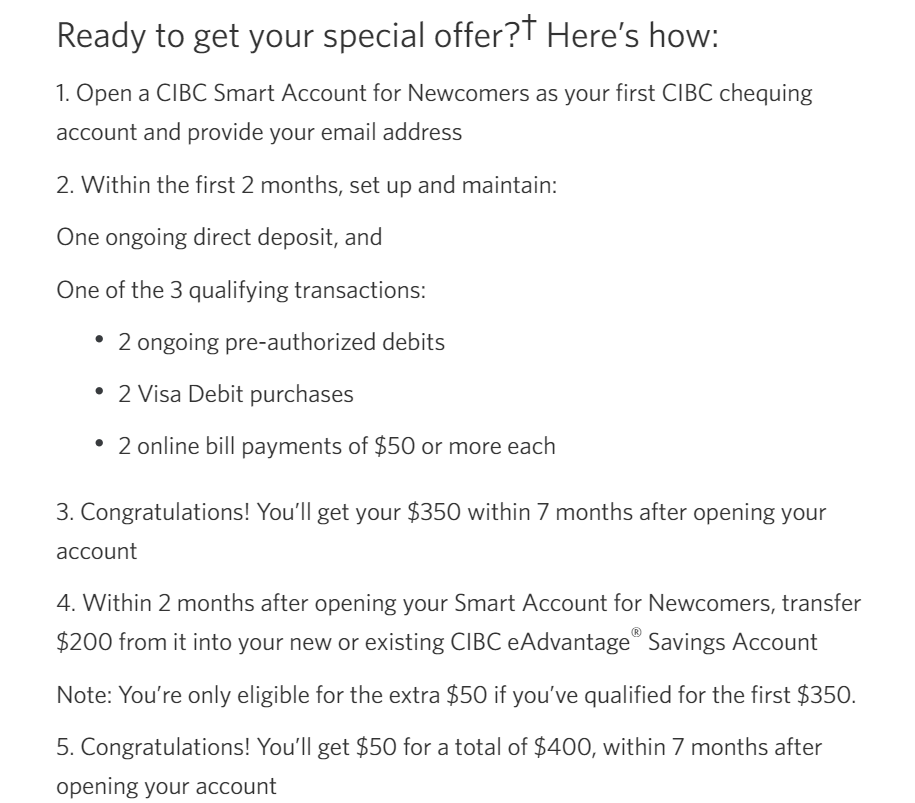

At CIBC you can earn an additional $400 sign up bonus. (Special Promotion 2022)

What is the "Global Money Transfer" from CIBC?

- It is a free way to transfer money to over 50 countries.

- Best and safest option if you don’t want to sign up with third-party providers.

- Minimum amount you can send in one transaction is $100 CDN

- Maximum amount is $30,000 per 24 hours

- The recipient receives the money within 1-3 business days.

- The money is transferred directly to the recipient’s bank account.

How is money transferred within Canada? Do I need the recipient's bank details?

In Canada, you do not need the recipient’s bank details, only their e-mail address. That’s right. Nothing else. It is called “Interac e-Transfer”.

In the online banking app, you select “e-transfer” and, in addition to the amount, also set a password that only the sender and recipient know. The recipient receives an e-mail notification and with the password they deposit the amount right into their account. Super fast and all done within 5 minutes.

Do I have to choose one of these "Big Five" banks?

There are also online banks in Canada with which you can do everything online. My two personal favorites that I use myself and I am very satisfied are Simplii and Tangerine.

Yay, the first Canadian credit card!

If you plan to immigrate to Canada or at least want to stay a little longer, the credit card is a good way to build a credit history. A credit history is important if you want to finance something, e.g. car or house.

In the first few months, you won’t be able to make big purchases with your credit card, because the credit limit will usually start at $500 as a newcomer. If you then pay your credit card bills on time, the credit limit can be tripled within 6 months. Or even go up to $3000. The bank will send letters with offer to increase the limit.

Very important information about the credit card!

Unlike in many other countries, the monthly invoice due amount is not automatically deducted from the chequing account, but you have to pay the bill manually via online banking. Therefore, it is important to register the debit card and credit card in online banking immediately after receiving them and to switch to online statements in the “statements” and notification. Then you will receive an e-mail every month with the note that there is a statement ready.

You will get a deadline until when the amount due has to be paid. It is always within 21 days after the monthly statement. (At least at CIBC)

What very few travellers know! And I learned the hard way.

- Always pay the full amount of the credit card before the due date mentioned in the credit card statement. If you either pay too late, or only a part of the amount, the outstanding amount will accumulate interest with high interest rates. These are 19-25% for pretty much all banks.

- Never withdraw cash with a credit card from an ATM, only with a debit card. If you withdraw cash with the credit card, this amount is considered “cash advance” and interest is charged at the above interest rates.

- Never transfer money to the credit card and then withdraw it or transfer it back to the chequing account. If you transfer money back from the credit card to your bank account, it is also considered a “cash advance” and the bank is going to charge high interest.