IEC - Health Insurance

Do I need health insurance for the Working Holiday?

For the International Experience Canada (which includes the Working Holiday) you must have health insurance for the entire duration of your stay in Canada. Your health insurance must cover:

- medical care;

- hospitalization; and

- Repatriation (transportation expenses to your home country in case of serious illness, injury or death).

So the answer to the question is, yes, it is a mandatory requirement of the IEC program to have a health insurance.

Your IEC health insurance must be valid for the entire stay in Canada.

If your insurance policy is valid for a shorter period than your expected stay, your work permit will expire at the same time as your insurance. This means you won’t be able to extend your work permit later, even if you originally planned to stay longer.

For example, if you arrive at the border with health insurance valid for only three months, you will receive a work permit that’s valid for exactly three months. After that, you’ll need to either return home or explore other work permit options.

Important if you are activating a second IEC work permit:

Provincial health care is not acceptable, because repatriation is not covered by provincial health insurance.

For example, if you’ve enrolled in MSP (Medical Services Plan) in British Columbia or OHIP (Ontario Health Insurance Plan), these plans cover basic healthcare services within the province, but they do not cover repatriation to your home country in case of a serious illness, injury, or death.

What are some IEC insurance options for Canada?

Here are some of the most highly recommended IEC health insurance options, suggested by other work and travellers, for you to compare and choose the coverage that best fits your needs.

Before you commit to a plan, review the fine print carefully. Each policy offers different coverage and has its own eligibility requirements—such as whether you must still be living in your home country—so make sure you understand the details.

Every year, thousands of workers and travellers who participate in the IEC program in Canada highly recommend these insurance policies, making them a trusted choice for the Working Holiday health coverage. Choose the plan that gives you the protection and peace of mind you need during your stay!

If you have a pre-existing condition, contact the provider directly to discuss any questions or concerns you may have.

The list contains affiliate links. We do not represent any of the insurance companies listed. This is for information only. When you buy insurance through those links, we may earn an affiliate commission but it will not cost you extra. Thanks for your support!

True Traveller

- For citizens from Europe and UK

- Available up to 24 months

- Can be extended by 12 months with a discount

- Already Travelling policy available

- Public Liability included in premium

- Additional coverage for winter sports possible

⚠️ NEW at True Traveller:

True Traveller offers refunds for unused months if you return home earlier, under the following conditions:

- You’ve been away for less than 12 months

- You haven’t filed any claims

- The policy wasn’t an ‘already travelling’ policy

Best Quote

- For all IEC countries

- Available up to 24 months

- Already Travelling policy available

- Website that helps find the best coverage

⚠️ Other key points that stand out at Best Quote:

- BestQuote is a well-established Canadian broker offering a variety of affordable policies, including coverage for pre-existing medical conditions like diabetes, asthma, allergies, and even more adventurous activities like rock climbing, backcountry skiing, bungee-jumping, or rodeo sports.

- It’s especially popular among IEC participants from Australia and New Zealand.

- BestQuote stands out with an IEC health insurance policy that provides a 25% refund of the remaining premiums (minus a $25 admin fee) once you sign up for provincial health care.

- They also offer easy access to Canadian primary care physicians through Maple’s virtual healthcare app, including 3 free prepaid doctor’s appointments per year.

- Additionally, if you return to your home country before the policy expires and haven’t filed any claims, BestQuote offers a partial refund of your premiums.

World Nomads

- For over 100 countries

- Available up to 12 months

- 'Already Travelling' policy available

Common IEC health insurance questions

What is the difference between 'health insurance' and 'travel insurance'?

In the IEC community the terms are used interchangeably, and that can be confusing.

Health insurance covers your unexpected medical expenses. It will pay for doctor visits, hospital stays, prescription medications, surgeries, and other health-related services.

Travel insurance will cover unexpected medical emergencies while traveling, but also may include other benefits like trip cancellation, lost luggage, flight delays, and travel-related emergencies.

In short, and in relation to the IEC program:

An insurance that includes emergency medical coverage is the mandatory requirement, but additional travel-related benefits, such as coverage for trip cancellation, lost luggage, or flight delays, are optional extras, not required by immigration.

What is the reason behind this strict requirement for the IEC program?

Firstly, and most importantly, with this requirement, the Canadian government wants to make sure you are not a burden on Canada’s health care system and that you have a chance to get back to your home country in case of injury, illness or death.

If you have a bad accident and need to be flown home for further treatment and need a flight with doctors and nurses, the Canadian government will not pay for your repatriation.

Secondly, many IEC participants who come to Canada are not eligible for provincial health care or not eligible right away. Specifically the ones who come with an open work permit under the Working Holiday category who explore Canada and travel and work in many other provinces. Therefore, making them ineligible for provincial health care.

Each province has its own rules for health coverage, and they can be quite strict. For example:

- Québec does not insure Working Holiday travellers.

- Ontario and British Columbia require a full-time job for at least 6 months before you can even apply.

As you can see, you might not be eligible for provincial coverage or not right away. Your IEC health insurance fills in these gaps and ensures you’re covered from the moment you arrive.

My country allows a 2-year work permit, can I buy 2x 1 year IEC health insurance policies?

When preparing for your IEC stay in Canada, it’s important to purchase a travel insurance policy that covers the full two years.

However, if you’re unable to find a provider that offers a single two-year policy, you can instead purchase two separate one-year policies. In this case, it’s crucial that there is no gap between the two coverage periods.

Keep in mind that the second policy must an “already travelling” policy which can be a bit more expensive. This is why I recommend to use an insurer that offers a 2-year-policy.

My insurer is unable to provide a 2-year policy. Instead, they offer a policy that automatically renews after the first year.

⚠️ This is a risky option under the IEC program.

When you arrive in Canada and activate your IEC work permit, the border officer will check your proof of health insurance. The work permit will only be issued for the duration of your prepaid insurance—not longer.

So if your policy only covers 1 year, your work permit will be issued for 1 year only, even if you’re eligible for a 2-year stay.

I highly recommend to look for an insurer that offers a 2-year IEC-policy (fully prepaid upfront). See the options above.

⚠️ Important:

Your insurance certificate must clearly state the full length of coverage (e.g. 24 months) at the time you enter Canada. If not, your work permit will be shortened, and you could lose a valuable part of your IEC stay.

I don't plan on staying the maximum time, can I take a shorter insurance policy?

If you’re certain you’ll be in Canada for only a short time, you can purchase health insurance for just that planned period—say, 6 months. This is a common choice for travellers who come only for the winter or summer season and then return home for good, with no intention of coming back to Canada.

Remember: your work permit will match the length of your health insurance, and it cannot be extended later.

However, if you’re unsure how long you want to stay, it’s not a good idea to purchase a shorter insurance policy to receive a shortened work permit. From experience, many people end up falling in love with Canada and wish to extend their stay. Unfortunately, a shorter work permit could prevent you from doing that.

I will only travel to Canada to activate the work permit, then return home to come back later

While this process is allowed and many travellers do this, it is very important to point out two things:

- At the time of activation of the work permit you need to have the full-length health insurance policy in order to receive the maximum work permit validity. For example from the UK, in order to receive a 2-year work permit you need a 2-year health insurance.

- Most insurance policies do not allow you to return to your home country without invalidating the policy. Please read the fine print of the health insurance policy.

I have health insurance coverage from my credit card; can I use that?

Unfortunately not. Credit card companies cover you for travels up to a certain amount of time, for example 45, 60 or 90 days.

You will receive a work permit for only 45 days, 60 days or 90 days with no option to extend.

I am already in Canada and have provincial health care, can I use this for my second IEC participation?

As mentioned above, provincial health care alone is not sufficient to activate a work permit under the International Experience Canada (IEC) program, including the Working Holiday category. This is because repatriation coverage is mandatory for IEC participants, and repatriation is not included in any provincial health care plan.

Additionally, since you are no longer in your home country, you must have an “already travelling” policy to ensure you’re properly covered once you arrive in Canada. Check out the options above.

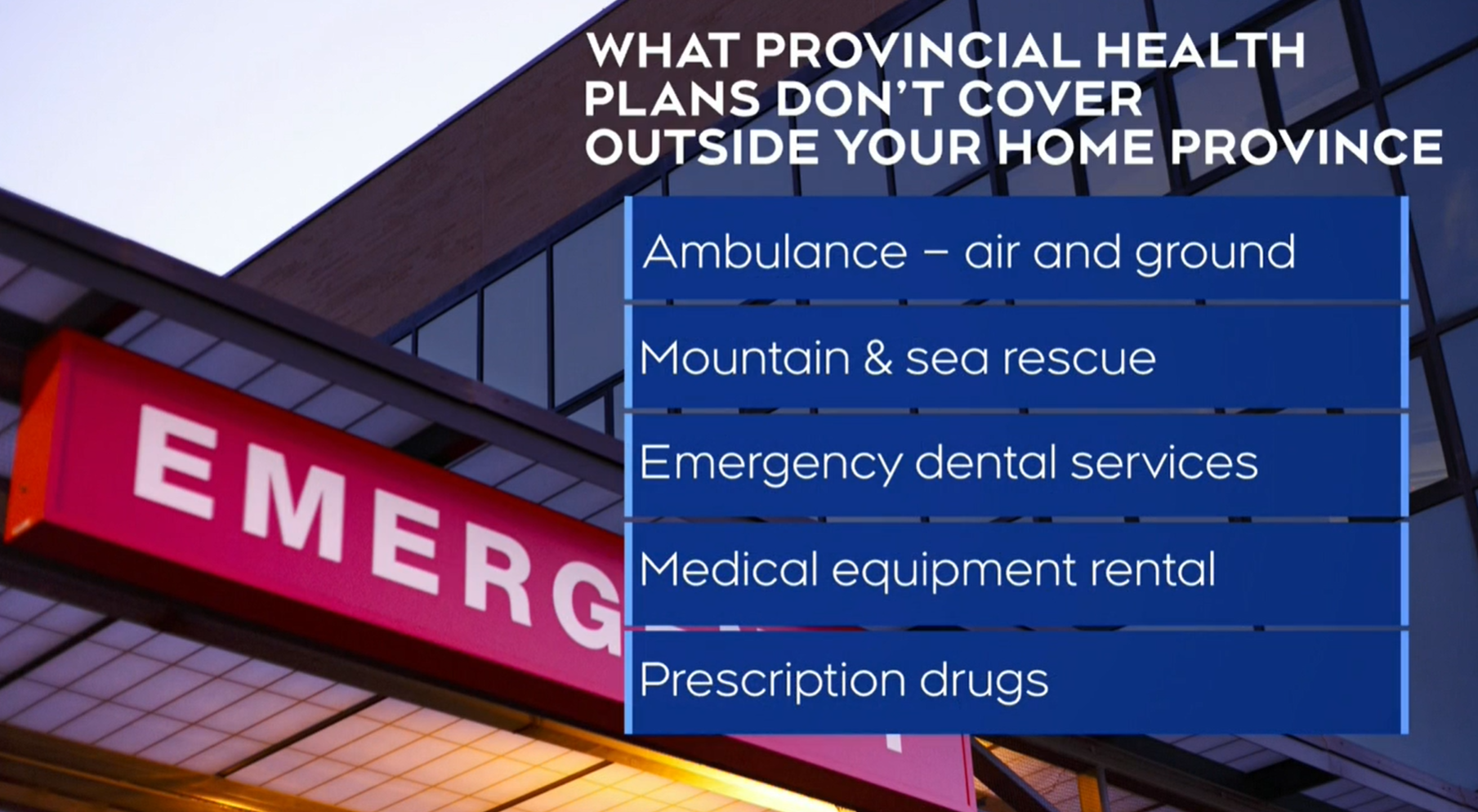

Many travellers think that provincial health care covers everything, but that’s not true.

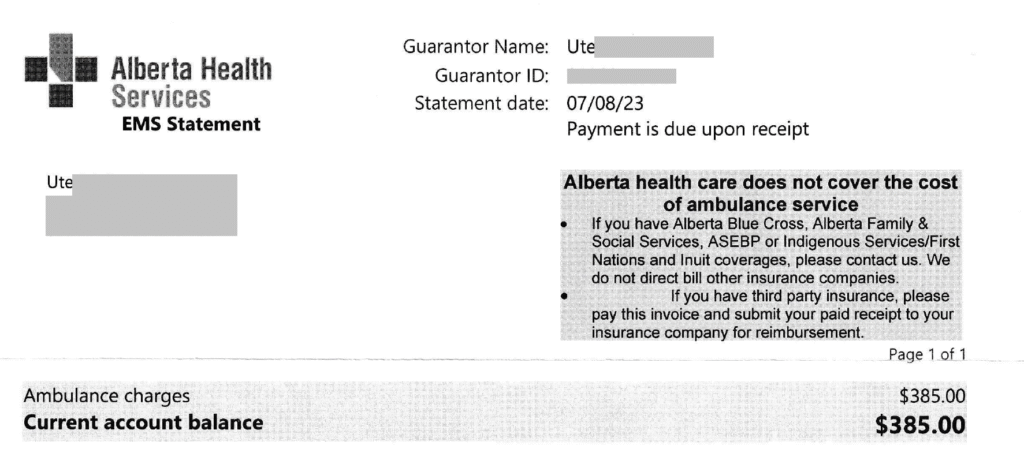

For example, provincial health plans don’t cover ambulance services. I learned this the hard way, I paid $385 out of pocket for an ambulance in Alberta because Alberta Health didn’t cover it.

Your IEC health insurance steps in where provincial plans don’t. If you have a medical emergency or an accident, it covers your ambulance costs, so you avoid surprise bills.

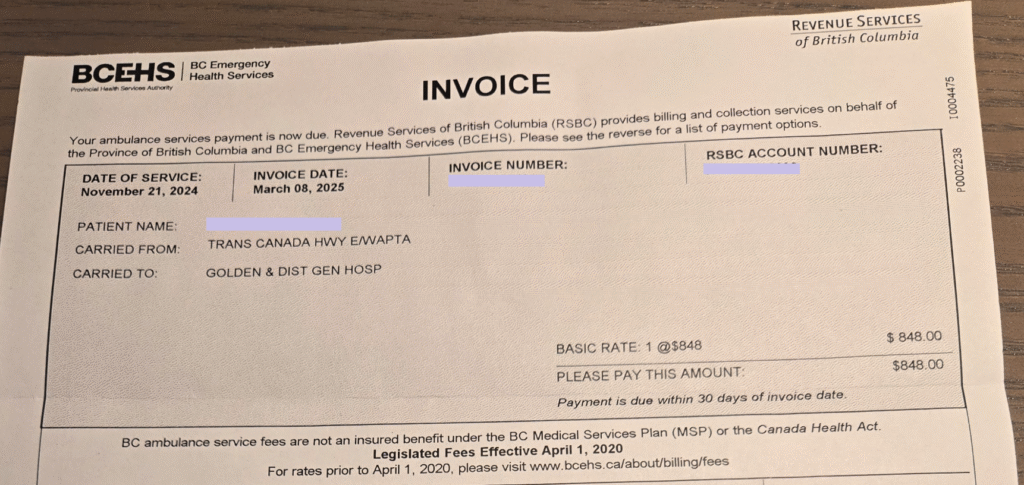

Also, provincial health care only covers you within your home province. If you travel or visit another province, you need extra “out-of-province” coverage. For example, I received an $848 ambulance bill in BC for an accident, even though I permanently live in Alberta and have Alberta Health care.

With IEC insurance, you’re fully covered across Canada, no matter which province you’re in.

Lastly, provincial health plans don’t cover dental care. Fortunately, your IEC health insurance provides dental coverage, with limits depending on the terms of your policy, so you’re most likely protected for emergency dental expenses.

Here’s just one recent example of many that appeared in the news (see article here):

(The key points are highlighted in the screenshot below, taken directly from the article.)

An Ontario man suffered a heart attack while visiting Alberta and was transported by air ambulance. He later received a $12,483 bill, despite believing he was fully covered.

This happened because provincial health plans like OHIP do not cover out-of-province air ambulance services, meaning he had to pay the full cost himself. Even within Canada, travellers on provincial health care plans must purchase additional coverage when they leave their home province.

Fortunately, your IEC health insurance provides worldwide coverage, including when you travel between provinces in Canada.

When I arrive in Canada I am eligible for provincial health care; can I then cancel my IEC health insurance?

Definitely no. It is a mandatory requirement to have health insurance for all three categories in the IEC program.

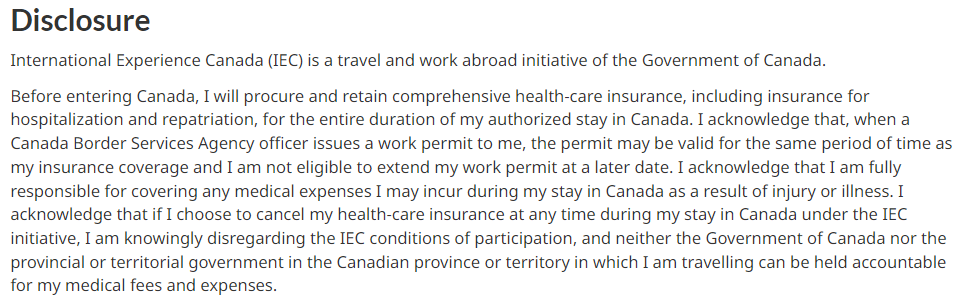

If you cancel the health insurance you are violating the conditions of your work permit, which can lead to it being revoked or invalidated. At the end of the Working Holiday application and before submitting it, you signed a disclosure to purchase adequate health insurance. “I didn’t know” is not an acceptable excuse.

Also, some insurance providers notify IRCC if a policy is cancelled. This can trigger a review of your work permit status.

If I cannot cancel; can I still have IEC health insurance and provincial health insurance at the same time?

Yes, you can. Provincial health care can be a great addition to your IEC health insurance. It covers routine medical needs, such as annual physicals and bloodwork, things usually excluded in travel insurance plans. That said, it doesn’t cover everything.

Most importantly, provincial health care does not cover repatriation. If you suffer a serious illness, injury, or worst case death, your family would be responsible for covering the costs to bring you home. That can run into thousands of dollars. It’s not something you’d want to burden your loved ones with just to save a few hundred dollars a year on proper travel insurance.

I am already in Canada and have employer benefits from work, can I use this?

Employer benefits can be a great way to get extra medical coverage while working for a specific employer. They often include dental, vision, massages, acupuncture, and more.

However, the IEC program does not accept employer benefits as adequate health insurance. Here’s why:

Eligibility depends on provincial health coverage. To use employer benefits, you must already have provincial health insurance. Without it, you may not be covered—so always read the fine print.

Repatriation limits. Employer benefits typically cover repatriation only to your Canadian home province or within Canada. IEC requires coverage for repatriation to your home country, which employer benefits don’t provide.

Coverage ends when you leave the job. Once you quit or are laid off, your employer benefits stop immediately, leaving you uninsured.

Because of these limitations, employer benefits cannot replace the mandatory IEC health insurance for your work permit.