Health Insurance for Working Holiday Travellers

Do I need health insurance for the Working Holiday?

Yes, it is the official IEC requirement:

For the International Experience Canada you must have health insurance for the entire duration of your stay in Canada. Health insurance must cover:

- medical care;

- hospitalization; and

- Repatriation (repatriation to the home country in case of serious illness, injury or death).

Provincial health care coverage is not acceptable. Repatriation is not covered by the provincial health insurance.

With all the comparisons you make on different websites, you simply think choosing the cheapest deal is enough. But that’s where many insurances differ. Especially in the cover amounts you should not cheap out. Medical expenses in the U.S. and Canada can be very expensive. A day in the hospital can cost up to $20,000 after an accident. It is recommended to take a policy with at least $1 Million coverage in medical expenses.

You must provide the policy of the health insurance at the time of activation of the work permit, i.e. when entering Canada. This means that the health insurance for the Working Holiday must be taken out before travelling to Canada.

Your health insurance must be valid for the entire intended stay in Canada.

If your insurance policy is valid for less than your expected stay, you will be issued a work permit that expires at the same time as your insurance. If this happens, you will not be able to extend your work permit later. For example if you show up at the border with a 3 month health insurance then you will receive a work permit for 3 months. That's it, after 3 months you can return back home.

What Working Holiday insurance options are there?

Below are the options you can compare to choose adequate coverage to your liking. Please make sure you read the fine print before signing up for one of the insurance options.

Thousands of work and travellers who come to Canada on a Working Holiday every year, recommend the following policies for the IEC Working Holiday health insurance.

The list contains affiliate links. We do not represent any of the insurance companies listed. This is for information only. When you buy insurance through those links, we may earn an affiliate commission but it will not cost you extra. Thanks for your support!

True Traveller

- For citizens from Europe and UK

- Available up to 24 months

- Already Travelling policy available

- Public Liability included in premium

- Additional coverage for winter sports possible

Young Travellers

- For German and Austrian citizens

- Available up to 24 months

- Refund of unused premiums if you return home earlier

- Very affordable premiums if you are under 25 years old

Best Quote

- For all IEC countries

- Available up to 24 months

- Already Travelling policy available

- Comparison website to help find the best coverage

Dr. Walter

- For all IEC countries

- Available up to 24 months

- Already Travelling policy available

- Refund of unused premiums if you return home earlier

World Nomads

- For over 100 countries

- Available up to 12 months

- Already Travelling policy available

My country allows 2 year work permit, can I buy 2x 1 year health insurance policies?

You should make sure to buy an insurance policy for the entire 2 years and fully paid upfront. If you cannot find an insurer that offers 2 years insurance policies, you can buy 2x 1 year policies. There cannot be a gap between the two policies.

The second policy must be an already "travelling" policy and could be more expensive in the premiums.

Not many insurers offer already travelling policies, this is why it is important to have one 2-year policy.

I don't plan on staying the maximum time, can I take a shorter insurance policy?

If you are absolutely certain you will stay in Canada for a shorter period of time, you can also take out health insurance only for the planned stay, e.g. only 9 months. An example is when travellers only come to Canada for the winter and summer season then return home for good.

If you are not sure if you want to stay the allowed time, it is not recommendable to take a shorter insurance and receive a shortened work permit. I guarantee you will fall in love with Canada and will want to stay longer, but because of the shortened work permit this would not be possible.

I will only travel to Canada to activate the work permit, then return home to come back later

While this process is allowed and many travellers do this, it is very important to point out two things:

- You need to have the full length health insurance policy in order to receive the maximum work permit validity. For example from the UK, in order to receive a 2 year work permit you need a 2 year health insurance at the time you activate the work permit.

- Most insurance policies do not allow you to return to your home country without invalidating the policy.

When I arrive in Canada I might be eligible for provincial health care, can I cancel my health insurance?

Definitely no. This mandatory requirement to have health insurance is specifically for all three categories in the International Experience Canada (IEC) program because many travellers who come to Canada are not eligible for provincial health care. Specifically the ones who come with an open work permit under the Working Holiday category mostly travel and work in many other provinces making them ineligible for provincial health care.

Depending on the province, there are strict requirements for provincial health care. Quebec for example does not insure travellers on a Working Holiday work permit, in Ontario you must have a full time job for at least 6 months, in BC there is a three months waiting time. You see that you will not be eligible for provincial coverage or not right away.

Provincial health care is a great addition to your existing health insurance from your home country. It is not a substitution, because provincial health care has basic coverage only. No dental, no vision, not even an ambulance is covered and in case of an accident you will get a high bill from the emergency services.

And more importantly, provincial health care does not cover repatriation and your family will have to pay the expenses in case you must be transported home in case of accident, illness or death. I am sure you would not want to do that to your family, just because you want to save a few hundred dollars per year on a good health insurance.

If you cancel the health insurance you are breaching the IEC requirement which can invalidate your work permit.

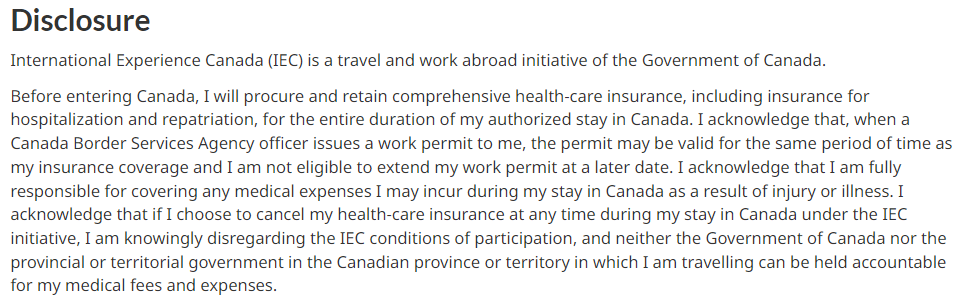

At the end of the Working Holiday application and before submitting it, you signed a disclosure to purchase adequate health insurance. There is no excuse later with "I didn't know"